Restaurant Credit Card Processing

Accelerate and grow your restaurant with affordable, efficient restaurant credit card processing and focus on what you do best - running your restaurant.

gET sTARTEDOmni-Channel Restaurant Solutions

From mom n' pop to chain restaurant stores, we have your restaurant credit card processing covered. Paymentsmith's restaurant credit card processing allows you to manage your customers, employees and tables all in one.

In-Store

Streamline and simplify the way you take your payments in person with revolutionary products designed to fit your unique business needs.

Learn MoreE-Commerce

Simplify the way you take payments online with all the tools and features needed to power your online business.

Mobile

Accept payments anywhere with our EMV enabled devices. Manually enter, dip or swipe with confidence and access reports in real time.

Learn MoreDon't gamble your business.

Protect your customers and your margins. From transparent pricing to state of the art technology, we help you scale and do commerce the way you want.

get startedMobile

Our mobile application offers a robust set of on-the-go payments. Boasting an EMV enabled mobile swiper, product categories for any business, and the ability to add tip and send email receipts, you’ll be able to move and groove wherever your business takes you. With on-the-go reporting and management tools keeping your business moving forward.

Learn More »

In-Store

We know every retail use case is different, which is why we have a robust set of POS tools to meet every challenge. From bespoke hotels and restaurants to sports venues and hardware stores, we do it all. Whether you need a stand-alone POS solution or a vertically integrated ERP system with back-office transactions, we have you covered there, too

Learn More »

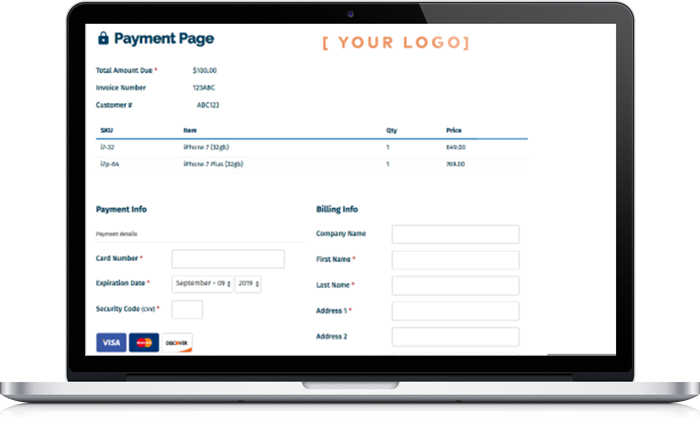

Online

Simple integration no matter your e-commerce requirements, your online store will be up and running smoothly with Paymentsmith. We’ve plugged into every major shopping cart, and are ready to architect a seamless and secure cloud based solutions thats tailored to your business with patented security to your your business out of scope. Don’t forget to ask about our subscription managment

Learn More »Customer Case Study: DK Express

Before switching to Paymentsmith, local Minnesota restaurant owner Du Quach thought that he was being charged interchange + $0.06, a standard pricing model for restaurant credit card processing. However, he was largely unaware of what was going on behind the scenes with his previous merchant services representative.

The Pricing

The Extreme Costs

In reality, Du was being charged ‘padded interchange’ + $0.31 and about $80 in fees per month. On top of that, he was charged $390 monthly for two very old devices on a four-year non-breakable contract. Now, it’s important to note that these devices are worth in total about $300 when new, so essentially Du had paid $18,720 for only $600 worth of old, out-dated devices.

We were able to drop his bill roughly $190 a month on his processing by simply eliminating excess fees and charges. We set him up with brand-new clover products, including two CloverFlex gateways and one CloverGo for deliveries, which he paid for outright ($900 total) with zero extra charges.

The Customer Service

The Poor Treatment

His previous rep was a frequent customer and would come in every week, coaxing him to switch to their ISO (Independent Sales Organization) for payment processing at D&K Express. After months, Du finally caved to his sale. Du figured since the rep was a consistent consumer, it would be a good business transaction. However, once he was set up and running with their system, the rep was nearly ‘unreachable’ and stopped eating at the restaurant completely.

“When I had issues with my device or questions on my bill, I would call and call and never get an answer,” says Du. “Being a business owner, I had little time to make a change, but I started to realize I needed to. I had no idea how bad it really was, so I let it go for way too long.”

Du knew he needed better customer service in a payment processing company. His search led to Paymentsmith, where a local representative, Tyler, came to the rescue.

The Resolution

How Paymentsmith Helps

Tyler took control of the situation and called the previous representative, trying to figure out how long Du had left in his previous contract. The representative did not answer his phone, so after several tries Tyler called the 1-800 “support” number and waited another 45 minutes to find out that they “did not have the authority to disclose information” and that the only option was to go through his representative. After many calls, emails and long holds - Tyler was able to get Du out of his processing contract, but he is still unfortunately finishing out his payments on his old equipment until term.

Restaurant Credit Card Processing

There's a reason restaurants switch to Paymentsmith. Actually, there's three reasons. It starts with communication, transparency and technology.

Communication

Paymentsmith provides real account management versus a customer service hotline. With Du's last restaurant payment processing provider, the lack of communication was what he disliked the most.

Transparency

Paymentsmith provides transparent pricing and expert walk-throughs to simplify the payment experience. With Du's previous representative, there was always an 'evolution' of pricing and lack of clarity.

Technology

Paymentsmith provides the newest technology and POS systems that do not slow down during the lunch rush. His old technology would go in and out every day, always failing at the worst times.

Want to Learn More About D&K Express?

Read the full story about this local Minnesota restaurant.

to the blog article